On this page

Sign up to our newsletter

Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.

Commercial real estate portfolios have never been more complex to manage. Each building today is a web of interconnected systems, HVAC, lighting, access control, energy meters, IoT sensors, and more. Yet in most cases, these systems still operate in isolation. For REITs, Class A property owners, and investment managers, this siloed reality creates blind spots that drive up costs, make ESG reporting a headache, and leave tenants frustrated when issues go unresolved.

At the portfolio level, the challenge multiplies. A single building with fragmented operations is inefficient; a portfolio of 50, 100, or 500 buildings with inconsistent standards and scattered data becomes almost impossible to manage effectively. Leadership often finds itself piecing together reports from multiple teams, tools, and formats, spending more time trying to understand what’s happening than actually improving outcomes.

This is why portfolio-wide visibility is emerging as the critical foundation for modern real estate operations. More than a buzzword, it marks the shift from reactive, building-by-building management to proactive, data-driven oversight across the entire portfolio. Done right, it empowers owners and operators to make faster decisions, standardize performance, and unlock the efficiencies that Class A tenants and investors now expect.

What Do We Mean by Portfolio-Wide Visibility?

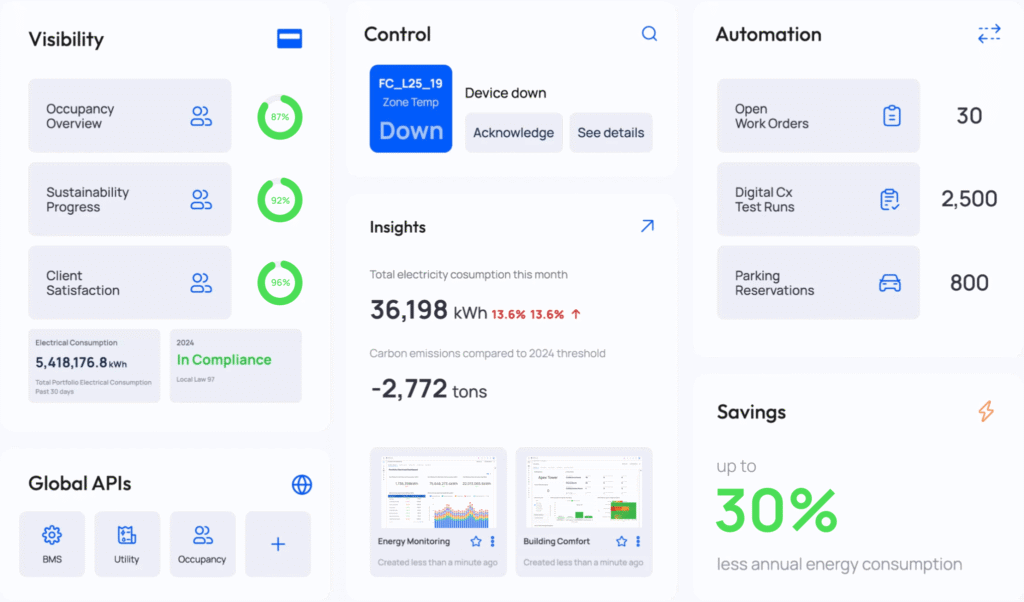

Portfolio-wide visibility means that building operators, asset managers, and executives can see and act on all relevant operational data across their entire portfolio in one place. This includes:

- Performance metrics: Energy consumption, CO₂ levels, air quality, occupancy, and comfort.

- Asset health: HVAC runtime, equipment performance, and predictive maintenance flags.

- Operational workflows: Work orders, alarms, commissioning reports, and diagnostics.

- Financial and sustainability KPIs: Utility costs, carbon reduction progress, and compliance status.

Instead of managing these insights building by building, and utilizing different platforms for each, leaders have a single centralized vantage point.

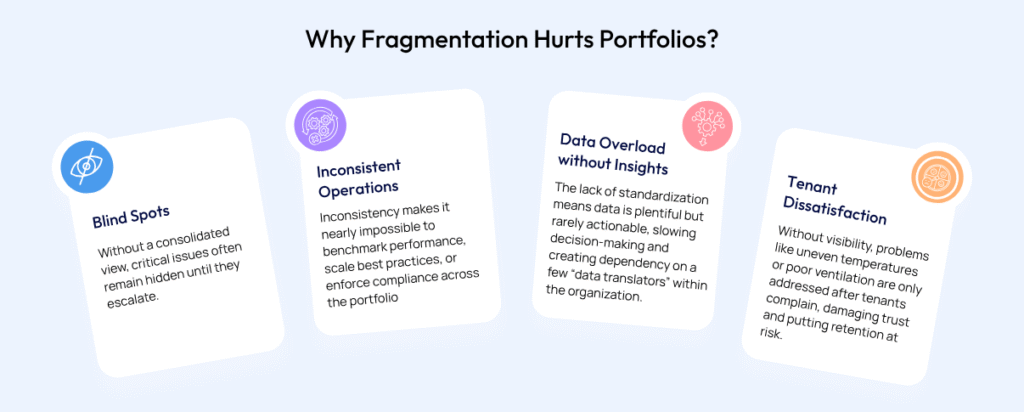

Why Fragmentation Hurts Portfolios

When building systems operate in silos, the impact extends far beyond day-to-day inefficiencies. It undermines the long-term performance of the entire portfolio. Some of the biggest challenges real estate leaders face without centralized visibility include, but are not limited to:

Blind Spots

Without a consolidated view, critical issues often remain hidden until they escalate. An unnoticed chiller fault or inefficient AHU schedule can quietly drive up energy bills month after month. By the time it’s caught, thousands of dollars have been wasted and sustainability targets may already be at risk.

Inconsistent Operations

Each building team typically develops its own processes and standards. One site may excel at preventive maintenance while another relies heavily on reactive fixes. This inconsistency makes it nearly impossible to benchmark performance, scale best practices, or enforce compliance across the portfolio.

Data Overload Without Insight

Operators often spend more time pulling reports from multiple systems and reconciling spreadsheets than actually solving problems. The lack of standardization means data is plentiful but rarely actionable, slowing decision-making and creating dependency on a few “data translators” within the organization.

Tenant Dissatisfaction

In Class A and premier workplaces, tenants expect seamless comfort, air quality, and sustainability credentials. Without visibility, problems like uneven temperatures or poor ventilation are only addressed after tenants complain, damaging trust and putting retention at risk.

For large REITs and enterprises with dozens or even hundreds of properties, these challenges compound quickly. A single inefficiency in one building may seem minor, but multiplied across an entire portfolio, the cost of fragmentation runs into millions of dollars annually, while also threatening ESG compliance and investor confidence.

Visibility That Translates Into Value

Centralized visibility isn’t just about having more data on a dashboard. It’s about transforming how decisions are made and how buildings are run. When leaders can see the full picture across their portfolio, they gain the ability to compare, prioritize, and standardize in ways that simply aren’t possible with fragmented systems. This shift delivers tangible benefits across finance, operations, and tenant experience:

1. Holistic Benchmarking

Leaders can identify which properties outperform or underperform on energy use, comfort, or maintenance response times. This enables smarter capital allocation and portfolio-wide improvement.

So what? Instead of spreading resources thin, investments can be directed toward the assets that will deliver the highest returns, while high-performing sites set the benchmark for others to follow.

2. Proactive Asset Management

Visibility into equipment performance across multiple sites helps extend asset life and reduce emergency repairs. Predictive insights ensure resources are used where they’ll have the most impact.

So what? Portfolios avoid costly downtime and surprise capital expenditures, freeing up budgets for innovation rather than emergency fixes.

3. Faster, Data-Driven Decisions

Executives no longer wait weeks for reports. Real-time insights make it possible to respond to market shifts, tenant demands, or compliance requirements instantly.

So what? This agility allows organizations to stay ahead of rising energy costs, regulatory deadlines, or changing tenant needs, turning operations into a strategic advantage rather than a liability.

4. Consistency Across the Portfolio

Standardized processes and data models ensure that every site, whether in Boston, Chicago, or London, operates with the same level of efficiency and accountability.

So what? With a unified platform and consistent workflows, operators can manage multiple buildings instead of just one, drastically reducing the time needed for onboarding and training. This consistency empowers teams to scale their impact across the portfolio without increasing headcount.

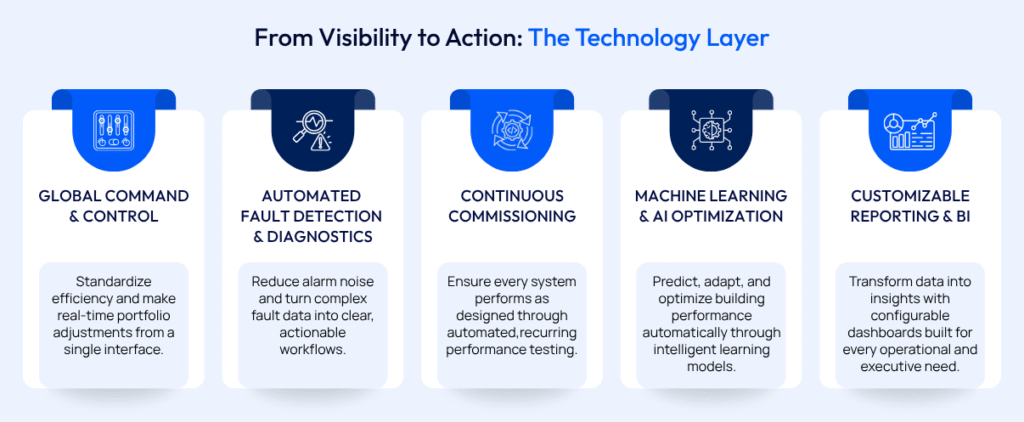

From Visibility to Action: The Technology Layer

Visibility is only valuable if it leads to action. Modern building operating systems turn portfolio insights into results by enabling:

- Global Command and Control: Adjust equipment schedules, setpoints, and runtimes across hundreds of sites with one action.

- Automated Fault Detection and Diagnostics (FDD): Incidents are identified, grouped, and pushed as work orders, reducing engineer workloads and accelerating resolution.

- Continuous Commissioning: Tools like Functional Testing (FTT) ensure systems stay optimized long after installation.

- Machine Learning & AI Optimization: Advanced platforms now embed ML and AI to move beyond monitoring into prediction and optimization. Algorithms learn equipment behavior, forecast energy demand, and automatically adjust operations.

- Customizable Reporting and BI: Dashboards track everything from sustainability performance to space utilization.

This layer transforms centralized visibility from “just another dashboard” into a true operating advantage.

Why This Shift is Urgent

The pressures facing CRE portfolios are mounting:

- Regulatory Compliance: ESG reporting, carbon neutrality targets, and building performance standards require accurate, portfolio-wide data.

- Tenant Expectations: Occupants want healthy, sustainable, and well-managed spaces. Poor performance impacts retention.

- Investor Pressure: Stakeholders demand operational resilience, lower operating costs, and evidence of sustainability progress.

- Labor Shortages: With fewer skilled technicians entering the field, automation and centralization reduce dependence on stretched human resources.

Centralized operations are no longer “nice-to-have.” They are a prerequisite for meeting today’s business, regulatory, and tenant demands.

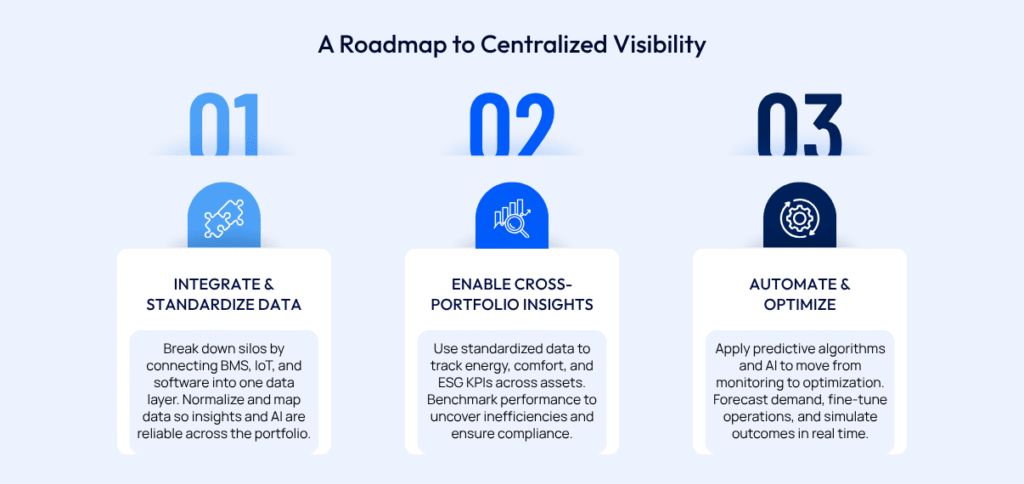

A Roadmap to Centralized Visibility

For portfolios just starting this journey, the transition to portfolio-wide visibility and intelligence typically unfolds in three stages. Each stage builds on the last, ensuring scalability and resilience as the portfolio evolves:

- Integrate and Standardize Data

The foundation lies in breaking down silos by connecting building management systems (BMS), submeters, IoT devices, and operational software into a common data layer. This requires not only API integration but also data normalization and ontology mapping, ensuring that disparate data points (e.g., zone_temp, cooling_command) are standardized and usable across the portfolio. Without this step, analytics and AI remain unreliable or inconsistent. - Enable Cross-Portfolio Insights

Once data is standardized, organizations can deploy advanced analytics and visualization tools. Dashboards allow operators and executives to monitor KPIs like energy intensity (kWh/sq. ft), tenant comfort scores, and ESG metrics across all assets. The ability to benchmark building-to-building performance helps surface systemic inefficiencies, prioritize upgrades, and validate compliance with emerging building performance standards. - Automate and Optimize

The final stage layers on advanced capabilities such as predictive maintenance algorithms, dynamic sequence of operations, and AI-driven energy optimization. At this stage, the platform moves from descriptive (“what happened”) to prescriptive (“what should we do next”) and predictive (“what will happen if no action is taken”). Machine learning models can forecast peak demand, optimize setpoints in real-time, and even simulate outcomes to support capital planning.

The key is to view this journey as a maturity curve: integration builds the data foundation, insights enable informed decisions, and automation delivers continuous optimization. By following this phased approach, portfolios ensure they’re not just adding another layer of complexity but instead creating a scalable digital infrastructure that adapts as new technologies, regulations, and tenant expectations emerge.

From Visibility to Resilience

The future of portfolio management isn’t fragmented, it’s unified, intelligent, and proactive. For large REITs and enterprises, the question isn’t whether to centralize operations. The question is: how fast can you get there? To learn more about how centralized operations could impact your portfolio, book a demo with our team.

FAQs

Portfolio-wide visibility refers to the ability to view and manage all operational data, such as equipment performance, energy use, equipment health, and comfort metrics, and more, across every building in a real estate portfolio from a single platform. This unified oversight helps owners, operators, and executives make faster, data-driven decisions and maintain consistent performance across all assets.

Centralized visibility eliminates data silos between building systems and sites, enabling standardization, benchmarking, and proactive management. It helps reduce operational inefficiencies, cut energy costs, improve ESG reporting accuracy, and deliver a consistent experience across all locations.

When systems operate independently, organizations face blind spots, inconsistent operations, manual reporting, and slower decision-making. These inefficiencies can lead to higher costs, poor tenant satisfaction, and difficulties meeting regulations and compliance goals, especially when managing large portfolios.

By consolidating all performance data into one platform, teams can identify inefficiencies, automate fault detection, and optimize energy use through AI-driven analytics. This leads to measurable outcomes such as up to 30% energy savings, fewer maintenance emergencies, and improved asset longevity, directly boosting ROI.

Modern building operating systems integrate technologies such as Cloud BMS, Fault Detection & Diagnostics (FDD), Functional Testing Tools (FTT), Building BI dashboards, AI-powered optimization, and more. Together, these tools automate monitoring, streamline maintenance workflows, and enable real-time control across multiple sites.

Rising regulatory demands, ESG reporting requirements, evolving tenant expectations, investor pressure for transparency, and labor shortages all make unified, automated operations a strategic necessity. Centralized visibility helps organizations stay compliant, competitive, and resilient in this changing landscape.