Retail banks sit at the heart of communities, operating thousands of branches, offices, and data centers worldwide. But behind the customer-facing experience lies a growing challenge: the cost of retail bank portfolio management is rising faster than many institutions can absorb.

Margins are tightening. Energy prices remain volatile. Regulatory expectations around ESG are accelerating. And yet, many banks still rely on fragmented systems and reactive maintenance practices to keep their real estate portfolios running. For many institutions, this is reshaping their approach to retail bank portfolio management.

The result? Escalating operational expenses (OpEx) that erode Net Operating Income (NOI) and limit long-term sustainability.

Why OpEx Keeps Rising

Fragmented Systems Across Distributed Branches

A global retail bank may operate 1,000+ branches across multiple countries, often with different building systems in each. Without a standardized view of performance, decision-making is slow, and opportunities for savings go unnoticed.

High Energy Intensity

On average, a commercial building consumes 23-28 kWh per square foot per year. A typical 2,500 sq ft retail bank branch uses approximately 57,500 to 70,000 kWh annually. Multiply this across 1,000 branches, and total energy consumption up to 70 million kWh per year, roughly the equivalent of powering 6,500 homes.

Even a 10-20% reduction through better scheduling, monitoring, and optimization could save $1-2 million annually, assuming an average electricity cost of $0.15/kWh.

Reactive Maintenance

Reactive maintenance is typically 2-3x more expensive than preventive or predictive approaches. For a retail bank spending around $20 million annually on facilities maintenance, even a 15% reduction enabled by predictive maintenance could unlock $3 million in savings while extending the lifespan of critical HVAC and electrical assets.

Compliance & Reporting Pressures

With regulations tightening, ESG reporting has become resource-intensive. For some organizations, manual reporting can consume weeks of staff time per quarter, equating to hundreds of hours of labor. Standardization not only reduces risk but also frees teams to focus on higher-value strategy.

Underutilized Space

Customer habits have shifted dramatically in recent years, with more transactions moving online or to mobile banking. As a result, many branches operate at partial occupancy while still consuming the same amount of energy and resources. If even 20% of a branch network’s space is consistently underutilized, the wasted energy and facilities costs can add up to millions in avoidable OpEx annually.

The Opportunities: Rethinking Retail Bank Portfolio Management

The challenges that drive up costs also provide an opportunity to rethink how we manage retail bank portfolio management.

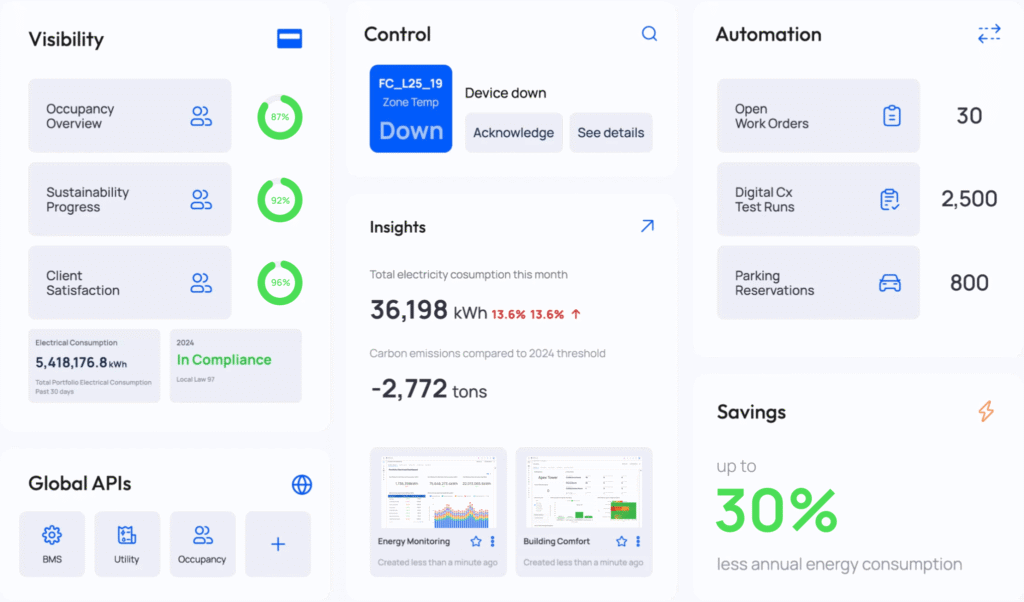

Integrated Oversight

Centralizing operational data across branches, offices, and data centers enables leaders to compare performance, identify savings opportunities, and make informed decisions at scale.

Energy Optimization

Aligning branch schedules and system operations with actual occupancy can deliver 10-30% energy savings across the portfolio, saving over $1 million annually for a 1,000-branch network.

Predictive Maintenance

Embedding fault detection and diagnostics reduces emergency repairs and avoids downtime. Extending asset life by even 1-2 years on HVAC systems across hundreds of branches can defer up to eight figures in capital expenditures.

Streamlined Reporting

Standardized data collection ensures compliance and regulatory disclosures are credible and efficient. This measure lowers compliance risk and boosts investor confidence, which is becoming increasingly important as regulators push for mandatory climate disclosures.

Space Utilization Alignment

By analyzing branch space usage, banks can cut energy waste, optimize cleaning and maintenance schedules, and develop long-term right-sizing strategies.

Impact Snapshot: What Smarter Portfolio Management Could Unlock

For a retail bank operating 1,000 branches (around 2.5M sq ft), rethinking retail bank portfolio management could deliver:

- +$2 million in annual energy savings through efficiency gains and optimized scheduling.

- +$3 million in yearly maintenance savings by shifting from reactive to proactive maintenance.

- +$10 million in deferred CapEx by extending equipment lifespans by 1-2 years.

- Millions in OpEx savings through right-sizing and optimizing underutilized space.

- Direct NOI uplift – every $1M saved in OpEx flows straight into NOI, strengthening valuations and investor confidence, reinforcing the strategic importance of operational efficiency for long-term success.

From Operational Burden to Strategic Advantage

Retail banks face mounting cost pressures, from rising energy prices and maintenance demands to tighter regulatory and investor expectations. But within these challenges lies one of the most powerful, and often overlooked, levers for change: their real estate portfolios.

By rethinking their approach to retail bank portfolio management, banks can move beyond fragmented operations and build integrated, efficient, and resilient systems. The outcome is more than cost reduction:

- Higher NOI as operating expenses shrink.

- More substantial investor confidence through transparent, reliable ESG performance.

- Long-term resilience as branch networks become more adaptable to shifting customer behaviors and regulatory demands.

Every percentage point of efficiency gained today not only saves money but also compounds across hundreds or thousands of sites in the future. For retail banks, strategic retail bank portfolio management is both the path to sustainable operations and to sustainable growth.

The organizations that act decisively now will not only weather today’s pressures but also position themselves as leaders in the financial landscape tomorrow.

Want to learn more about how leading organizations are benefiting from this approach in their portfolios? Book a demo with our team.